Original Source: www.francetvinfo.fr

The article discusses the current public debt situation in France, highlighting the alarming levels of borrowing and interest rates that have soared compared to other European countries, particularly Germany. This disparity, reflecting a lack of investor confidence, stems from rising concerns over France’s economic stability and the political environment. As the nation grapples with a significant public deficit, the European Commission’s support juxtaposes the reality of France’s fiscal performance. The narrative warns of dire consequences should the situation deteriorate further, potentially impacting France’s sovereignty.

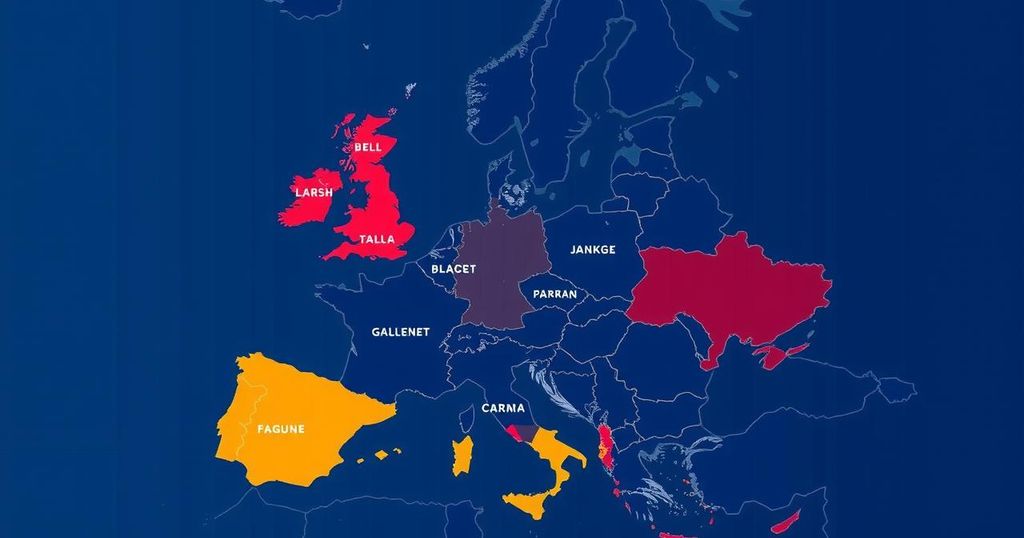

In the heart of Europe lies a narrative steeped in financial anxiety—France appears to be the classroom mischief-maker grappling with its homework of debt. The nation’s staggering €3.228 trillion debt has compelled it to borrow at interest rates far steeper than its neighbours; France now teeters precariously at 3.05% for a ten-year bond, dwarfed by Germany’s steadiness at 2.21%. This widening chasm in borrowing costs, reminiscent of the turbulence during the eurozone crisis, whispers tales of investor mistrust, particularly from those overseas in America and China.

Once upon a time, the French economy basked in the glow of political stability, even if it indulged in fiscal excesses. However, the plot thickens with rising fears that budgetary instability might lead to a government collapse, prompting lenders to demand hefty risk premiums. This shift in economic perception paints France as fragile, despite the assurances from Brussels’ offices, which commend the nation’s commitment to fiscal recovery.

Yet, the harsh reality remains that France is grappling with a significant public deficit, recorded at a daunting 6.2% of GDP. This figure positions it as the worst performer among the 27 EU states—only Romania lags behind. As the storm clouds gather, Standard & Poor’s stands poised to announce a verdict that may continue this downward spiral, endangering the very sovereignty of a nation teetering on the edge of over-indebtedness.

Should the winds of change blow unfavourably, interest expenditure might soar past essential sectors like education and defence, a grim prospect that could strip France of its capacity for decisive action. In the shadow of pressing deadlines and uncertain futures, France must confront the daunting shadows of its own economic narrative, fraught with peril but holding the potential for a courageous metamorphosis.